How Many Teachers at Academy of Art University San Francisco

'It'due south ruined my life': Academy of Art ex-educatee owes $431,000 and has no job

This is a carousel. Apply Side by side and Previous buttons to navigate

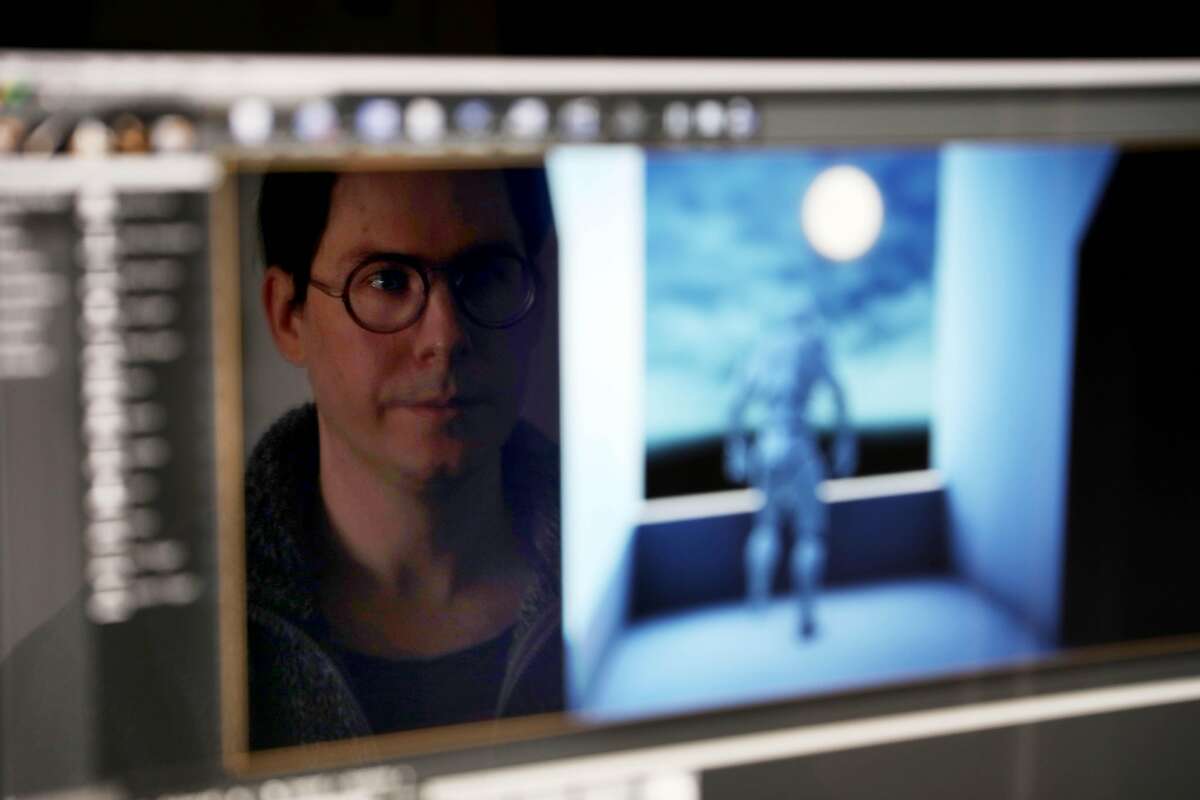

Shaun Dunn is an expert three-D designer whose images look so real you want to pluck them off the screen — the very sort Hollywood studios Disney and Pixar might pay an artist big money to create.

Or so Dunn believed when he was a top educatee at the Academy of Fine art Academy in San Francisco, whose ads say graduates "are some of the most successful and sought-after professionals in fine art and pattern today." Dunn earned a available's degree in industrial blueprint and stayed, at the schoolhouse's urging, he said, for his master'southward in animation and visual effects. He graduated in May.

Today he's broke. He owes $431,607 in pupil loans and hasn't gotten a job. His mother co-signed one student loan for his undergraduate studies in 2004 and remains on the claw for four subsequent loans. They barely speak now.

"Information technology's ruined my life," Dunn, 38, said of the debt and the "guerrilla techniques" he says the for-turn a profit Academy of Art used to persuade him to stay at the school he couldn't beget and oftentimes felt too ill to attend, thanks to a painful inflammatory disease that slowed his progress. "I but experience they were dishonest, saying you've got this swell future in front of y'all. But I feel we were ripped off. Bamboozled. Tricked."

With 13,000 students, nearly 40% online, the University of Fine art bills itself every bit the "largest private accredited art university in the U.S." It touts the success stories of graduates — but tells a unlike story to the U.South. Department of Education: iii out of 4 undergraduates never graduate. For those who do, median salaries within a twelvemonth of graduation range from $xix,100 to $46,500, depending on what they studied, says the department's College Scorecard, which premiered in 2015 and relies on schools' data.

A federal lawsuit by 4 ex-employees accuses the Academy of Art of using illegal schemes to bait students like Dunn. The one-time recruiters say the school illegally adapted their pay up or downwards based on how many students they registered, dangled trips to Hawaii as an incentive, and lied to the government about information technology to collect millions in fiscal aid.

Lawyers for the schoolhouse have said its methods were allowable at the time and have tried for a decade to get the high-stakes suit thrown out.

Now, as the case marches toward an April 27 trial, The Chronicle spoke with 17 former students who independently contacted the paper after reading stories about the lawsuit. Students are non part of the adjust, just they're at the heart of the case: Federal law prohibits "incentive compensation" to discourage schools from enticing unqualified applicants or those who can't afford it. Of the 17 ex-students, 12 take debt above $50,000, including viii higher up $100,000.

Like Dunn, most earn too petty to pay off the debt. They say the Academy of Art pushed them to borrow while hinting at lucrative careers with Facebook, Google, DreamWorks or Apple — all featured prominently on its website or in its "Make Your Dreams a Reality" ads.

Academy of Fine art officials declined repeated requests for comment.

Most former students don't work at those famous companies. Simply some do, according to LinkedIn. And some are achieved, like Rick Baker, the Academy Accolade-winning makeup artist.

At that place is too Candace Chambers, 32, a digital marketing consultant in Oakland who earned a primary'south in multimedia communications nine years agone from the Academy of Art. A reporter found her through LinkedIn and spoke with her to learn whether the experience of a graduate who didn't contact The Relate matched that of those who did. The answer? Yes and no.

With skills learned at school, Chambers has been a production assistant, news reporter, social media director and digital content manager. She's a freelancer now and runs a separate online vesture business.

"I went there thinking, 'I'm going to accept to pay for this, so let me have advantage of every resources and become out as rapidly as possible,'" said Chambers, who graduated in a yr and a half. She owes $80,000. She's in forbearance, allowing her to skip payments for a year, though interest accrues.

"I would do it again," she said.

The ex-students who contacted The Relate said they would not. Unemployed or working modest jobs, they include a Lyft driver in New Jersey who earned a primary's in flick and tv in 2013 and owes $160,000, plus a teacher's adjutant in Oakland who earned a available's in motility pictures and video in 2000 and owes $57,000.

Those who didn't graduate include a specialty food-maker in Stockton who owes $124,000, a phlebotomist near Tracy who owes $40,000, a stay-at-home dad in San Diego who owes $24,000, and a $10-an-hr dishwasher in Texas who owes $4,000.

What they accept in common is shame at their bad decisions and acrimony at the school. They believe they were like shooting fish in a barrel prey for the Academy of Art: artistic, low-income people who lacked guidance about choosing an affordable higher.

"Of course I blame myself. But that school was a predator," said Michelle Gardner, 55, of Daly City, who graduated in 1993 with a bachelor's in advertizement and a heart full of enthusiasm. She spent years peddling her portfolio to ad companies around the country before taking a social services task that pays less than $lx,000. Her original $xxx,000 loan has ballooned to $168,280.

"Information technology'due south the cloud that darkens every day for me," said Gardner, who is 5 years into a repayment program for public employees that forgives student loans after 10 years.

The University of Art charges $2,889 per course for undergraduates, rising to $3,033 next fall. Add together that tuition to the school's mandatory fees, and the base charge will be $26,399. With living expenses, the cost for 2020-21 volition top $44,000, federal data show.

Non everyone can afford it — or the student loans, plus interest, they might demand to pay for information technology.

"Skillful schools provide advice based on students' backgrounds and assistance them effigy out if taking a loan out is right for them," said Bob Shireman, who helped craft the Obama administration's "gainful employment" rule, which penalized career colleges when former students had loftier debt and low loan-repayment rates — clues they were not well-prepared for good jobs. The Trump administration repealed the rule in July.

"Predatory activity is telling students that there's financial help, downplaying that it's loans, and allowing them to believe they'll do good from paying off the loan," said Shireman, now college education director at the Century Foundation think tank. "It tin happen anywhere, just 99% of complaints are about for-profit schools."

Undergrads at for-profit colleges borrow more coin than other students, according to the National Center for Education Statistics, which looks at borrowing habits every four years. The average amounts borrowed for college by students who graduated with a available's degree in 2015-16 were $43,600 for private for-profits; $32,500 for private nonprofits; and $27,900 for public.

More recent information bear witness that University of Fine art graduates comport 59% more debt, on average, than grads from other 4-yr schools in California: $35,862 versus $22,585, according to College Insight, a projection of the nonprofit Institute for College Access & Success, which studies student debt.

Founded as the Academy of Advertizing Fine art in 1929 past artist Richard Stephens, the school today is endemic by his granddaughter, Elisa Stephens, a society figure and one of San Francisco'south largest landlords. She or her express liability corporations ain 43 buildings, mainly for pupil housing and classrooms. The metropolis sued in 2016, maxim Stephens illegally converted many of the buildings and eliminated 160 units of affordable housing.

They settled that year for $threescore one thousand thousand. Stephens agreed to restore affordable housing but never did. On Jan. 7, the Board of Supervisors amended the settlement to have the urban center create the housing at Stephens' expense.

The Academy of Fine art offers degrees in 22 fields, from acting to web design, but reports a graduation charge per unit of just 28%. The school collected more than than $i.5 billion in federal student loans and $171 million in federal grants from 2006 to 2018, a Chronicle analysis of federal records shows.

In their lawsuit, the ex-employees say those millions are what motivate the schoolhouse to vigorously court students and take all applicants.

"No one was turned away," said plaintiff Scott Rose, who is suing under the federal Fake Claims Act, which awards triple amercement to encourage whistle-blowers who believe the government is being cheated.

Dunn, who earned two degrees and is seeking piece of work while developing his 3-D art website, has filed for Affiliate xiii defalcation protection to defer loan payments for five years. He was an Academy of Art educatee for 14 years. And with the school'southward encouragement, he said, he took out 25 loans.

"I was adamant to defy the odds," he said. His dad had repaired copiers, and his mom raised the kids. Neither had a caste. But Dunn's teachers urged him to get one. His parents divorced when Dunn was xviii, leaving him to wrestle with college on his own.

He loved drawing, and found the University of Art. In that location he learned about pupil loans, and when his mother co-signed one for him, he was in.

In his sophomore yr, while on the graveyard shift at his part-fourth dimension task, Dunn of a sudden felt knifelike pains in his stomach. A doctor diagnosed Crohn's disease, an incurable inflammatory disorder that would change Dunn'due south life. He became more determined than ever to stay in school.

"If I didn't, what would I accept? Cypher. No degree, no health. But bills," he said. "And so I had to keep going."

The school, likewise, was determined that Dunn stay.

"They were, similar, all over me," he said.

Dunn wasn't the merely family member affected by his conclusion to go to the Academy of Art — and stay there.

"Shaun's loans have buried me," said his mother, Gianna Lupo, of Oregon. Years before, she co-signed a $25,000 student loan with Sallie Mae, at present Navient.

"I was a single mom trying to assistance my son get an education for something he really adored," Lupo said. She didn't read the fine print and didn't realize she would automatically become responsible for afterwards loans — 4 of his 25. With interest climbing nearly $800 a month, her portion is approaching $200,000, with no end in sight.

"It merely became a monster," said Lupo, 59, who has dreamed of retiring to Italy. But a lawyer warned that leaving would be considered loan evasion.

"Information technology'due south put a lot of separation between my son and myself," Lupo admitted. She also blames herself — and the Academy of Art University.

"I've ever been leery of this schoolhouse," she said. "I call back it turned out to be kind of a sham."

Nanette Asimov is a San Francisco Chronicle staff writer. E-mail: nasimov@sfchronicle.com Twitter: @NanetteAsimov

Source: https://www.sfchronicle.com/bayarea/article/Ex-students-blame-for-profit-Academy-of-Art-15061438.php

0 Response to "How Many Teachers at Academy of Art University San Francisco"

Postar um comentário